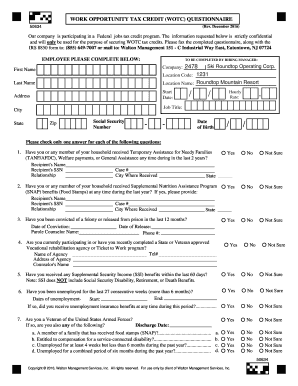

work opportunity tax credit questionnaire form

Fill Edit Sign Forms. Is participating in the WOTC program offered by the government.

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

The form may be completed on behalf of the applicant by.

. ETA Form 9061 Individual Characteristics Form. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training. Ad We take the confusion out of ERC funding and specialize in working with small businesses.

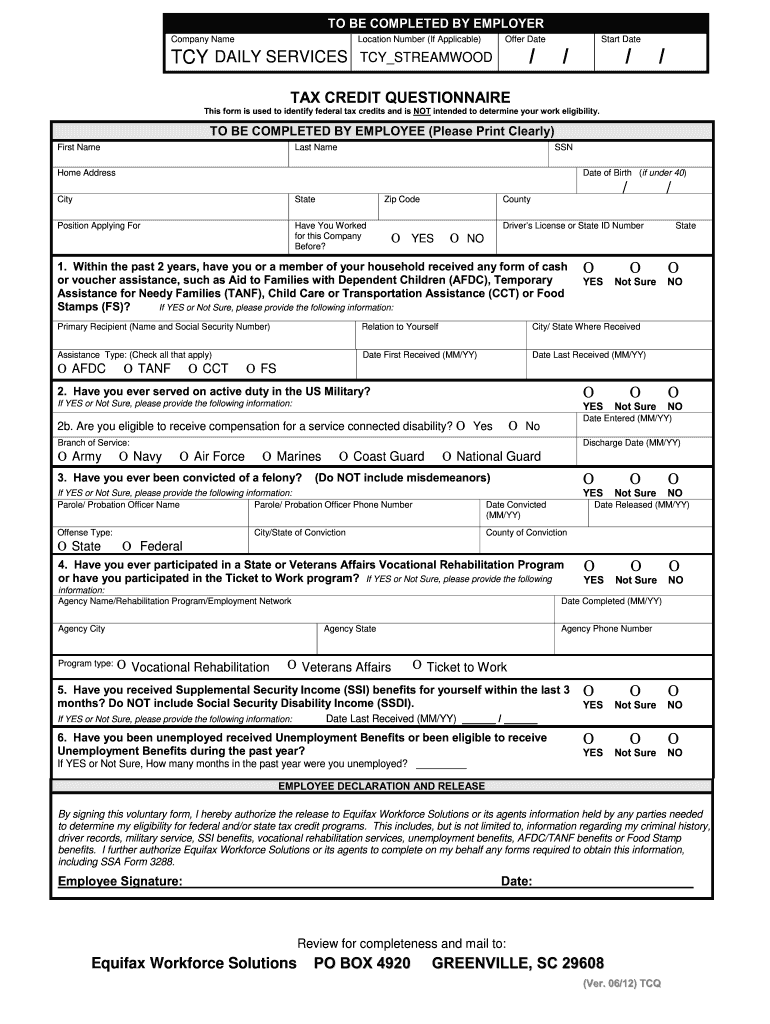

The job seeker or the employer must complete the Individual Characteristics Form Work Opportunity Tax Credit ETA 9061. Information about Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit including recent updates related forms and instructions on how to file. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the.

PdfFiller allows users to Edit Sign Fill Share all type of documents online. The Work Opportunity Tax Credit is a voluntary program. Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file.

We Document Eligibility Calculate ERC Submit. No limit on funding. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now.

In addition to these forms you will need an IRS 5884 Form and the Tax Credit Certification issued to you by the Wisconsin Department of Workforce Development Tax Credit Unit. Check to see if you qualify. The tax credit amount under the WOTC program depends on employee retention.

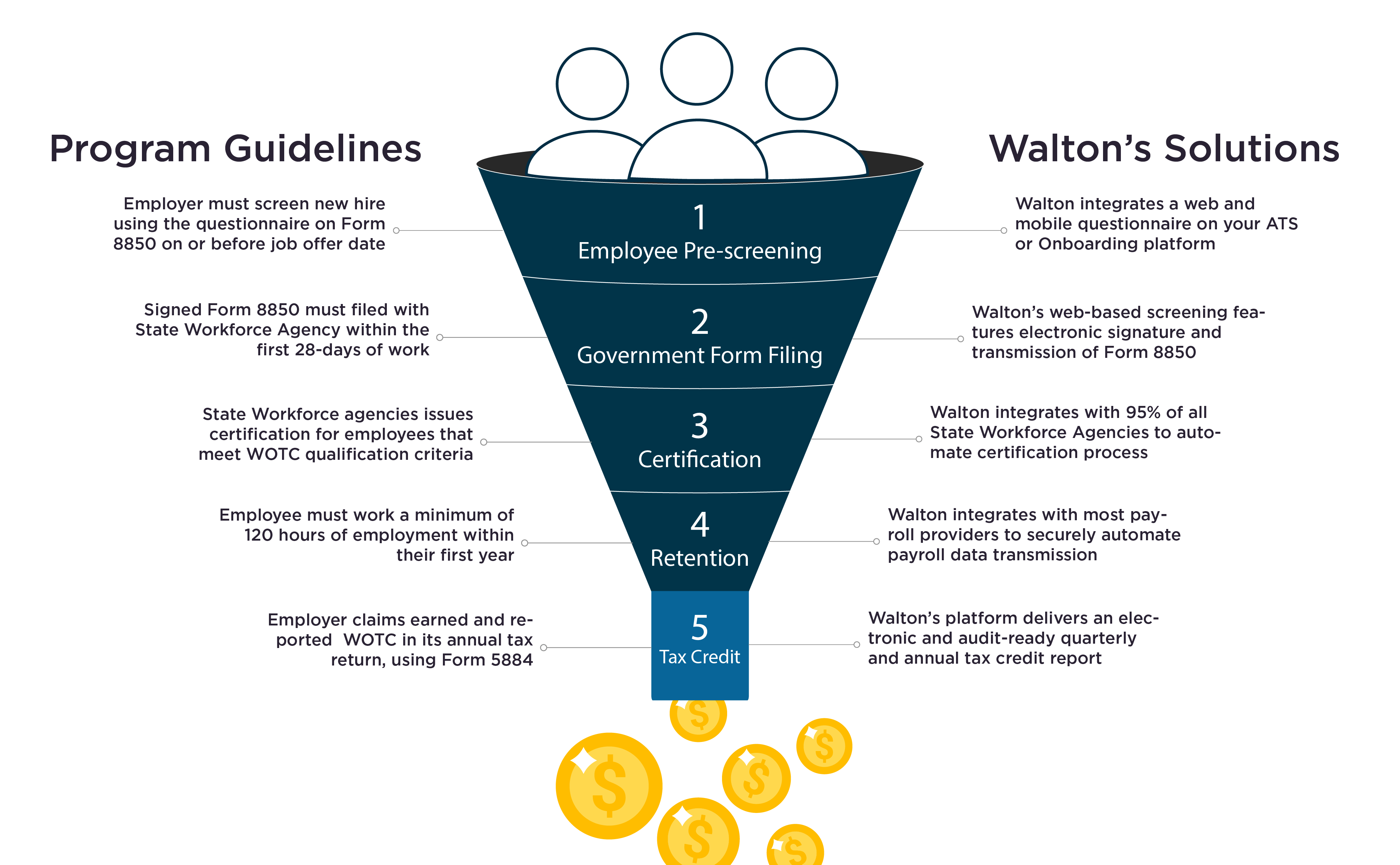

The employer and the job seeker must complete the. Work Opportunity Tax Credit Authorization Center. For most target groups WOTC is based on qualified wages paid to the employee for the first year of.

Ad Web-based PDF Form Filler. Edit Sign and Save TALX Tax Credit Questionnaire Form. After starting work the employee must meet the.

The employee groups are those that have had significant barriers to. Now creating a Wotc Questionnaire requires at most 5 minutes. Our state online blanks and complete recommendations eliminate human-prone mistakes.

Work opportunity tax credit questionnaire page one of form 8850 is the wotc questionnaire. Up to 26000 per employee. The state work opportunity tax credit WOTC coordinator for the SWA must certify the job applicant is a member of a targeted group.

The credit is 25 of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours and 40 for those employed 400 hours or more. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers. A work opportunity tax credit questionnaire helps to find out whether a company is following the Work Opportunity tax credit program as directed by the Federal government.

WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. Ad We take the confusion out of ERC funding and specialize in working with small businesses. ETA Form 9062 Conditional Certification.

WOTC Eligibility Questionnaire The Work Opportunity Tax Credit program WOTC promotes workplace diversity and facilitates access to good jobs for American workers. No limit on funding. April 27 2022 by Erin Forst EA.

Select a Premium Plan Get Unlimited Access to US Legal Forms. Comply with our simple steps to. Ad Get Up To 26k Per W2 Employee No Revenue Decline Necessary Schedule Your Free Consult.

Employers file Form 5884 to claim the work opportunity credit. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Our Average ERC Client Receives over 1M.

Employment Development Department. ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form. The program has been designed to promote the.

Check to see if you qualify. Help state workforce agencies SWAs determine eligibility for the Work Opportunity Tax Credit WOTC Program. Up to 26000 per employee.

Retrotax Tax Credit Administration Jazzhr Marketplace

Wotc Form Pdf Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credits Wotc Walton

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Completing Your Wotc Questionnaire

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credits Wotc Walton

Completing Your Wotc Questionnaire

With Wotc Timing Is Everything Wotc Planet

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit First Advantage

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet